UNDERSTANDING THE CONTRIBUTION TO THE UN SDGS

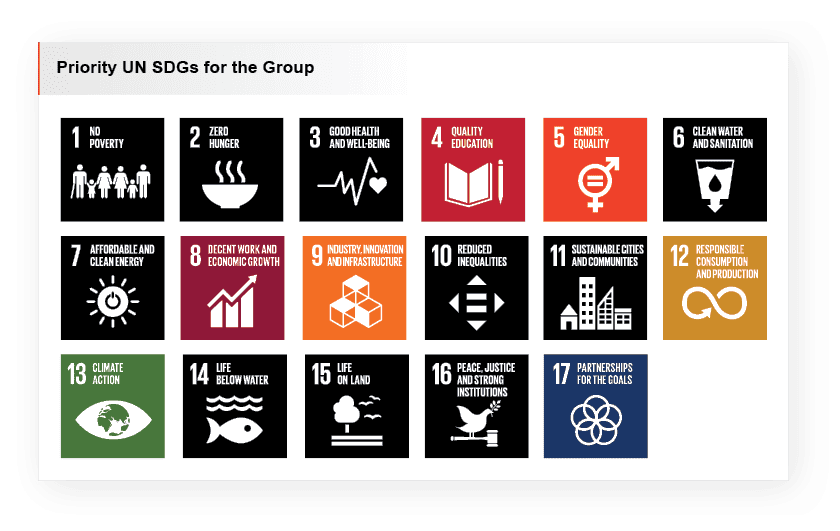

In 2020, Moscow Exchange conducted an analysis of all 17 UN SDGs and the 169 targets related to each one. Based on these findings, Moscow Exchange identified seven priority Goals and set its corporate objectives with consideration for the specifics of the Group’s activities and the objectives of the UN SDGs.

A range of projects was defined for each corporate objective, and metrics were developed to assess the Group’s contribution to meeting the UN SDGs.

Quality Education (SDG 4)

Moscow Exchange Group’s ESG strategy includes two areas corresponding to this goal:

- projects for novice investors, entrepreneurs, and a wide range of people who would like to learn to effectively manage their finances (for example, a project to promote financial and investment literacy);

- corporate training programs for staff.

In 2021, Moscow Exchange held the annual Ring the Bell for Financial Literacy event in a bid to promote wider financial literacy. It was a great opportunity to bring all stakeholders together and celebrate the progress made by each participant. Moscow Exchange also develops and offers new educational products each year.

Read more about this in the subsection “Genuine partnership and engagement with the community” of the section “2021 Sustainability Performance Highlights”.

Each year, employees of the Group’s companies are offered the opportunity to undergo training, and the scope of the educational programs and training keeps expanding. The average number of training hours per employee For employees who have undergone training. grew from 12 hours in 2020 to almost 19 in 2021.

Read more about this in the subsection “Environment of respect and empowerment” of the section “2021 Sustainability Performance Highlights”.

Gender Equality (SDG 5)

A large part of Moscow Exchange’s HR policy is attracting highly qualified employees, tapping into their potential, and ensuring high motivation and engagement. The Group companies monitor gender balance using a number of indicators, including the staff structure. They have achieved stable male/female parity indicators (56.7%/43.3%) among the workforce; the share of women in leadership positions (36% of department heads) is also relatively high. This attests to the Group’s adherence to gender equality principles.

Read more about this in the subsection “Environment of respect and empowerment” of the section “2021 Sustainability Performance Highlights”.

Decent Work and Economic Growth (SDG 8)

The companies of the Group have succeeded in creating appealing working conditions for staff. Meanwhile, senior management places a strong emphasis on occupational health and safety, fair pay, and rewarding employees for their achievements.

The Company cares about the comfort and success of its employees, providing them with extended VMI and healthy lifestyle program memberships. Moscow Exchange finances a number of hobby clubs, including MOEX Smart, a cooking club, MOEX Walk, and various sports teams. In addition, the Group keeps expanding its social and educational programs. Since 2020, Moscow Exchange has been providing sustainability training for employees in their main areas of activity.

The Group also promotes access to finance for small and medium-sized enterprises, which helps create new jobs in this sector. The number of SMEs that have gone public on Moscow Exchange increased from three in 2018 to 28 in 2021.

Read more about this in the subsections “Environment of respect and empowerment” and “Responsible investing and sustainable growth of the section “2021 Sustainability Performance Highlights”.

Industry, Innovation, and Infrastructure (SDG 9)

Responsible financing is one of the Group’s strategic priorities in the field of sustainable development. Moscow Exchange takes global trends and changes in capital markets into account in building an economy that will be more sustainable over the long term. This main objective of the ESG strategy is the Group’s contribution to SDGs 9, 12, and 13.

Moscow Exchange creates favorable conditions for attracting capital not only to SMEs, but also to innovative startups. The number of innovative companies that entered the financial market rose to nine in 2021.

Moscow Exchange ensures its clients have equal, unhindered access to sustainable products that are useful for all categories of investors and market players. Active development of the Finuslugi.ru personal financial services platform continued in 2021; OFZ-N federal loan bonds will become available on this platform to everyone in the future. Moscow Exchange also strives to improve the financial literacy of the country’s residents and works on ESG projects.

In December 2021, Moscow Exchange leveraged Finuslugi.ru personal financial services platform to introduce the first service for buying and selling retail bonds issued by Russian regions.

In addition to its range of sustainable products, Moscow Exchange has spent years building a solid, secure IT infrastructure. The results are impressive: zero breaches resulting in leakage of personal data, zero financial losses from information security failures, and zero outages of the information system.

Read more about this in the subsection “Responsible investing and sustainable growth” of the section “2021 Sustainability Performance Highlights”.

Responsible Consumption and Production (SDG 12)

The Group does its best to reduce its own environmental footprint by implementing climate and environmental programs at its offices and data centers, as well as by introducing responsible investment practices. Moscow Exchange’s activities include implementing responsible investment instruments, helping improve the quality and quantity of ESG-related disclosure by issuers, and promoting companies’ awareness of sustainability trends.

Read more about this in the subsections “Resource efficiency and environmental impact” and “Responsible investing and sustainable growth” of the section “2021 Sustainability Performance Highlights”.

Climate Action (SDG 13)

Moscow Exchange Group’s ESG strategy includes three areas that correspond to this goal:

- reducing its own climate footprint and participating in the creation of market instruments;

- facilitating the transition to a circular, low-carbon economy through green finance, and creating new exchange-traded environmental products and services;

- procuring goods, work, and services with the best environmental characteristics.

By following the roadmap and introducing new energy-saving measures annually, the Group’s companies reduced energy intensity by 21% (1.46 GJ/RUB million in 2021 compared to 1.85 GJ/RUB million in 2019); the intensity of electricity consumption by data centers also shrunk 10% compared to 2019.

A key milestone of Moscow Exchange in 2021 was the transition to the use of green power generated at the Ulyanovsk wind farm. In early 2022, Moscow Exchange entered into an additional commission agreement for the supply of green energy to the DataSpace data center. The supply of green power in 2022 is expected to cover over 90% of Moscow Exchange’s consumption. The use of renewable energy sources by Moscow Exchange is consistent with sustainability best practices.

Moscow Exchange spent the past two years conducting a climate risk scenario analysis, and in 2021 it developed measures for each scenario to reduce its climate footprint and better adapt to climate change. Following the TCFD recommendations, the Group identified two significant types of risk: physical and transition-related. Moscow Exchange assessed climate risks for five types of risks: market, political/legal, reputational, physical, and technological. A financial estimate will be calculated for all risks within each type, and events of low and high probability will be identified. The Group is currently working on climate-related goals and metrics, aiming to approve them in 2022.

Read more about this in the subsections “Climate agenda” and “Responsible investing and sustainable growth” of the section “2021 Sustainability Performance Highlights”.

Partnerships for the Goals (SDG 17)

Moscow Exchange supports international and industry initiatives aimed at cooperation on sustainability issues.

Read more about this in the subsection “Genuine partnership and engagement with the community” of the section “2021 Sustainability Performance Highlights”.

102-15

UN SDGs | Moscow Exchange Group’s corporate objectives matching the UN SDGs | Key projects of Moscow Exchange Group | Metric | 2021 results |

|---|---|---|---|---|

4.3 | Promote financial literacy | Investment and financial literacy program Ring the Bell for Financial Literacy annual event |

| ~1,031,000 |

| 2,806,373 | |||

| Held in 2021 | |||

4.4 | Develop staff professional and technical skills | Training courses in hard skills and events to develop the IT community |

| 46,644 |

| 19 | |||

4.7 | Build employee competencies needed for effective sustainability management within the Company | Sustainability management training courses |

| 10 |

UN SDGs | Moscow Exchange Group’s corporate objectives matching the UN SDGs | Key projects of Moscow Exchange Group | Metric | 2021 data |

|---|---|---|---|---|

5.5 | Ensure gender balance at the Company | An employee survey to identify any forms of discrimination. The findings will be used in developing inclusiveness and sociocultural diversity. It is planned to scale the survey up to cover issuers |

| By gender:

By category:

By employment type:

By employment contract type:

|

5.5 | Promote gender balance in the wider business environment | Ring the Bell for Gender Equality annual event | Gender equality matters are featured in the Sustainable Development Guide for Issuers, developed in 2021. Ring the Bell for Gender Equality annual event | Featured Held in 2021 |

UN SDGs | Moscow Exchange Group’s corporate objectives matching the UN SDGs | Key projects of Moscow Exchange Group | Metric | 2021 data |

|---|---|---|---|---|

9.3 | Expand growth opportunities and improve access to finance for small and medium-sized enterprises (SMEs) | Growth sector |

| 16 issues/16 issuers |

| 7.9 | |||

9.b | Expand growth opportunities and improve access to finance for companies developing innovative products | Innovation and Investment sector |

| 9 |

| RUB 12.5 billion: bonds; USD 500 million: securities | |||

| RUB 335 billion | |||

9.1 | Increase access to financial services for individuals |

| 4 | |

| 16,779,069 | |||

| 2.4 | |||

| 4 | |||

9.b | Ensure sustainability of financial infrastructure | Information security programs |

| 18 |

| 100% |

UN SDGs | Moscow Exchange Group’s corporate objectives matching the UN SDGs | Key projects of Moscow Exchange Group | Metric | 2021 data |

|---|---|---|---|---|

12.4 13.1 | Do not exceed the current office greenhouse gas emission intensity and strive to reduce it | Measures to reduce greenhouse gas emissions |

| 2.2 t CO2/person |

| 0.08 t CO2/RUB million in revenue | |||

12.4 | Do not exceed the current office water consumption intensity and strive to reduce it | Measures to reduce water consumption |

| 12.2 m3/person |

| 0.4 m³/RUB million in revenue | |||

12.2 13.1 | Do not exceed the current office and data center energy intensity and strive to reduce it | Measures to save energy |

| 40.37 GJ/person |

| 0.38 GJ/RUB million in revenue | |||

12.4 12.5 | Do not exceed the current office waste generation intensity and strive to reduce it | Measures to reduce office waste and increase recyclable waste |

| 0.15 t/person |

| 21.9 t | |||

12.6 13.3 | Raise companies’ awareness of sustainability trends, standards, and practices | Outreach events |

| Released in 2021 |

| 11 events | |||

| 1,293 participants | |||

12.6 13.3 | Develop instruments to promote responsible investing | Listing rules |

| 10 listings |

| 8.8 | |||

| 10 types | |||

12.6 12.8 | Improve the quality and quantity of ESG-related disclosure by issuing companies | Listing rules Outreach events |

| Released in 2021 |

| 361 people * 2 hours of presentation time | |||

|