SCOPE OF ACTIVITIES

102-2

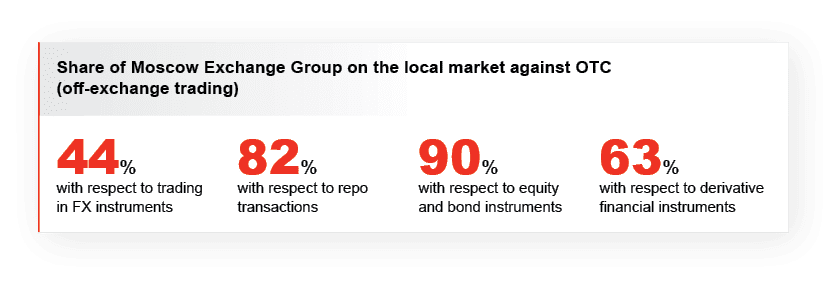

Moscow Exchange Group provides a full range of trading and post-trading services in five markets (Equity, Bond, FX, Money, Commodity, and Derivatives) to individuals and legal entities. Securities of companies from all sectors of the economy are represented on Moscow Exchange.

102-4 102-3 102-6

The Group operates in Russia, and it has a single customer service center located in Moscow. Moscow Exchange also owns a 13.1% stake in the Kazakhstan Stock Exchange (KASE).

102-1 102-2 102-5 102-6

Moscow Exchange Group includes Public Joint-Stock Company Moscow Exchange MICEX-RTS, which operates the only multifunctional exchange platform in Russia for trading in equities, money market instruments, derivatives, foreign currencies, precious metals, and other assets The Group also comprises the following non-banking organizations: a central depository (NCO National Settlement Depository JSC, or “NSD”); a clearing center (National Clearing Center JSC, or “NCC”), which performs the functions of a central counterparty on the markets; and other entities. Moscow Exchange PJSC owns 100% of the shares in NCC and 99.997% of the shares in NSD. In 2021, Moscow Exchange PJSC acquired INGURU, a leading platform for selecting insurance and banking products (the asset consists of two separate legal entities: Insveb and Disovers). Moscow Exchange also increased its share in OTC FX, the trading platform of Bierbaumpro AG. The key asset of Bierbaumpro AG is NTPro. A list of other Group entities is provided in the 2021 Annual Report (p. 5) and in the financial statements (Note 4). . Moscow Exchange PJSC provides trading opportunities for equities, bonds, derivatives, currencies, money market instruments, and commodities For more information on the business model, see the 2021 Annual Report (pp. 6-7). . In 2021, about 6,000 local and 1,000 global instruments, including ESG instruments, were traded on Moscow Exchange.

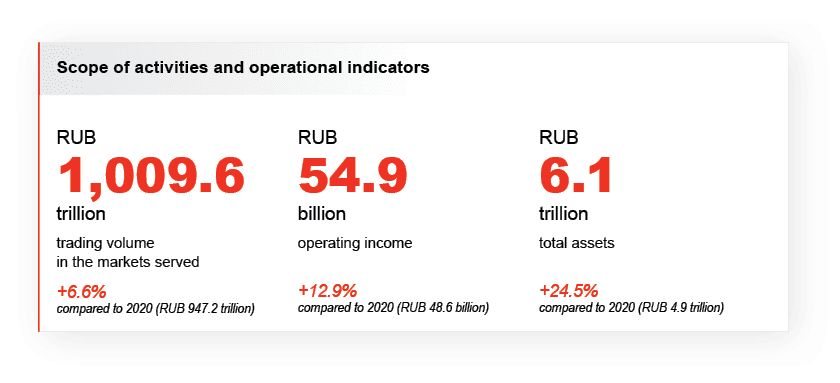

At the end of 2021, Moscow Exchange achieved record operating and financial results. This can be attributed to several factors: an influx of private investors, a more active primary market, extended trading hours, and the launch of new products and services.

In 2021, there were six initial public offerings (IPOs), including three placements that were exclusive to Moscow Exchange. A secondary public offering (SPO) was carried out by 11 companies, the total value of which was more than RUB 500 billion.

102-7