TRUSTED AND RESILIENT MARKET INFRASTRUCTURE

For data from 2019, 2020 and 2021, see the subsection “Trusted and resilient market infrastructure” of the section “Sustainability Data”. For the key policies, procedures, and responsible departments, see the subsection “Trusted and resilient market infrastructure” of the section “Sustainability Approaches and Procedures”.

103-1 FN-EX-550a.3

A market’s effective functioning and appeal are determined by its infrastructure , which should ensure high-quality and accessible information for traders, brokers, and investors; reliable barriers to deter market manipulation and conflicts of interest; smoothly operating IT systems; and the ability to process substantial flows of information between issuers and providers of capital.

Cybersecurity Market infrastructure means payment systems, central security depositories, security settlement systems, and central counterparty and trade repositories. is an integral part of Moscow Exchange Group’s risk management strategy and system. Measures taken to enhance information security ensure that the quality of management systems and the reliability of infrastructure are in line with global best practices.

This subsection describes measures that Moscow Exchange Group takes to ensure business continuity, including the reliability of information, data confidentiality, availability of operations, and information security.

- UN Sustainable Development Goals

- SDG 9.b Ensure sustainable financial infrastructure

2021 highlights

Risk management

103-2 102-15

The overall risk management system aims to guarantee reliable infrastructure. Since 2021, Moscow Exchange Group has been implementing the

The Group’s progress towards achieving the goals and objectives established in the strategy is monitored regularly: status reports are submitted to collegial executive bodies for review. We also use KPIs to assess the effectiveness of the risk management system.

As part of the Strategy and Roadmap, Moscow Exchange has implemented an approach to determining its risk appetite. The component risks The risk appetite of each Group company includes a breakdown of the Group’s risk appetite and individual metrics reflecting the particular companies’ specific risks. carry equal weight and are deemed to be material for the Group and all its companies.

ESG risk management

102-15

The expectations and interests of the Group’s stakeholders align with Moscow Exchange Group’s high level of preparedness for new ESG risks and opportunities. Approaches to identifying priorities and opportunities are determined based on the company’s strategic goals and objectives.

By analyzing key sustainability trends, risks, and opportunities at an early stage, the company can enhance its strategic performance. Prioritizing key economic, environmental and social issues as risks and opportunities is an integral part of Moscow Exchange Group’s operations and internal processes.

In the reporting year, Moscow Exchange Group achieved all its goals and objectives. This lays a solid foundation to further develop the risk and opportunity assessment process with respect to sustainability.

201-2

In 2021, Moscow Exchange began assessing climate-related risks and opportunities in line with TCFD recommendations.

To develop its tools for managing climate-related risk and opportunities, Moscow Exchange plans to achieve the following:

- assess climate-related risks and opportunities;

- include climate-related risks in the risk map for further monitoring;

- train staff to predict probable events and threats.

The short-term horizon (12 months) includes an annual review of transition and physical climate risks, as well as regular monitoring of the conditions and rules for identifying them. Moscow Exchange incorporates international practices for identifying and assessing climate-related risks into its operations.

The following climate-related risks were identified in the reporting period:

- transition risks, including market, reputational, political, legal, and technological risks;

- physical risks (acute and chronic).

Moscow Exchange Group is expanding its partnerships with various institutions in order to disseminate knowledge and expertise. It is developing models for identifying and assessing climate-related risks. More information on TCFD initiatives can be found in the subsection “Climate agenda”.

Emerging risks are identified systematically, and the business units responsible for managing the risks detected are designated during the identification phase. For each risk, a management strategy and mitigation measures are developed in accordance with the risk management system. Each risk is controlled and monitored.

Information security

FN-EX-550a.3

Moscow Exchange Group is implementing the

The Group’s companies have electronic and computer crime and personal liability insurance policies to mitigate operational and information security risks.

Robust IT infrastructure

The Group’s computing facilities are in two state-of-the-art data centers (DC): DataSpace (main, Tier III compliant) and M1 (standby). In 2019, Moscow Exchange replaced the network technology stack in both the data centers and its office buildings, introduced a separate type of co-location zone network connection for high-speed FIFO links, and revised how it organizes fiber-optic links between points of presence to ensure higher data replication speeds.

In 2021, Moscow Exchange replaced its equipment with advanced and powerful virtualization stacks with a higher energy efficiency class for dedicated virtual and utility resources. It also purchased new networking equipment for its office on Spartakovskaya Street.

In July 2021, the Group launched the DevOps production and development platform, including various streamers and services. Over the year, most development pipelines were successfully unified, the target approach for CI/CD processes on Moscow Exchange was approved, and the MVP development portal was launched. These activities have resulted in simplified and unified IT processes, a stronger engineering culture, and improved reliability and stability of products developed.

Data governance activities implemented:

- an operational data quality management model to minimize risks (reputational, regulatory, operational) and improve business users’ satisfaction with data services was launched;

- the target operating model for evolving data monetization tasks was approved;

- the DataOps business line was launched, and a data depersonalization platform and practices were introduced, accelerating the production of data platforms and services thanks to external teams;

- the MLOps platform was launched to reduce t2m tasks in implementing AI/ML solutions;

- data lifecycle management principles were formulated to optimize TSE and improve data efficiency.

Access to products and services

FN-EX-550a.3

Moscow Exchange provides equal, user-friendly access to its products for all types of investors and market participants.

In 2021, Moscow Exchange completed the process of connecting participants, providing a more efficient and user-friendly experience via dedicated communications channels:

- personal accounts for prospective clients were created; prospective clients can now access Moscow Exchange and NCC services;

- various directory checks and reporting functions have been automated;

- in a trading and clearing member’s personal account client questionnaires are now pre-filled with information from the Unified State Register of Legal Entities.

Thanks to these innovations, clients now have a convenient and transparent tool that makes accessing Moscow Exchange’s services quick and easy.

In 2022, work will continue on developing prospective clients’ personal accounts. Clients will be able to sign contracts and submit applications via a single interface, which will vastly improve the client onboarding process.

Finuslugi.ru

The Group continues to develop the Finuslugi.ru personal finance platform by adding new financial service providers and expanding the product range. In the future, OFZ-N federal loan bonds, and other products from banks, asset managers, and insurance companies will become available on the platform.

In 2021, the following significant updates were made to Finuslugi.ru:

- the opening of recurring deposits was introduced;

- comprehensive vehicle insurance can now be purchased;

- consumer loans are now available;

- mortgage insurance can now be purchased;

- Bonds of the Russian regions are now available; these can be purchased exclusively through Finuslugi.ru, without opening a brokerage account;

- a new multi-product site was launched;

- instant top-up of wallets and deposits.

Registrar of Financial Transactions

The Registrar of Financial Transactions (RFT) began operating alongside the Finuslugi.ru platform. The RFT, designed on the basis of NSD, accumulates information on all transactions made on any financial platforms. In 2021, the following milestones were achieved:

- the list of registered products was expanded;

- the “Bonds on the Marketplace” project was implemented; the first issuer was the Government Administration of the Kaliningrad Region.

Access to transactions with subfederal loan bonds

In December 2021, the Finuslugi.ru platform launched the first service for purchasing and selling subfederal loan bonds of constituent entities of the Russian Federation. Russian regions’ guaranteed-income securities will only be traded on Moscow Exchange, and no brokerage account will be required to purchase them.

Not only are bonds a tool for improving the financial literacy of the public, they also facilitate ESG projects: funds raised will be used to clean up bodies of water, reclaim landfill sites, and implement urban redevelopment projects.

The Kaliningrad Region’s coupon bonds are available for purchase. The coupon rate is 9% per annum, with a minimum investment amount of RUB 1,000. All the funds raised will be put towards development and improvement of the Kaliningrad Region. Investors will be able to choose a project to invest in, and they will receive a quarterly report on its implementation. Information on implementation of the project will be provided by the Kaliningrad Region.

Consumer lending service

In 2021, the Finuslugi.ru platform of Moscow Exchange launched a consumer lending service. Now, users of Finuslugi.ru can choose loans and other services offered by various banks directly in their personal account at favorable rates entirely online, without setting foot in a bank. The new service expands Finuslugi.ru’s product line. Clients can choose favorable offers for deposits, consumer loans, mortgages, car loans, and car insurance; these can be opened 24/7. Such offers by SKB bank and Center-invest Bank are already available on Finuslugi.ru. The number of partner banks will grow in the future.

MOEX Treasury platform

In 2020, Moscow Exchange launched MOEX Treasury, a terminal for corporate clients with direct access to trading. MOEX Treasury allows bidders to perform transactions on Moscow Exchange markets through a single user-friendly interface, including:

- conversion and swap transactions on the FX Market;

- deposits with a central counterparty on the Money Market;

- hedging opportunities on the Derivatives Market;

- deposit auctions in the M-deposits segment.

MOEX Treasury also provides integration with bidders’ personal accounts, as well as access to the Transit 2.0 system, which is an advanced platform used by banks and corporations to exchange financial messages and electronic documents. The solution is based on NSD’s Electronic Data Interchange (EDI) system. In 2021, it connected 14 banks and 26 corporations.

In 2021, MOEX Treasury started developing digital financial assets in accordance with the legislation; a customer engagement initiative was also implemented which expanded the number of corporate clients relative to capital markets.

In the reporting period, Moscow Exchange acquired the OTC FX platform, NTPro. The platform offers its clients liquidity aggregation, matching and execution services across a wide range of currency instruments, and services for connecting to more than 60 providers of foreign currency liquidity. The average daily turnover of the NTPro platform in 2021 was about USD 7.5 billion. NTPro technologies expand the range of opportunities for clients of both companies, presenting them with flexible and modern NTPro trading solutions for FX transactions in conjunction with the clearing and settlement services of Moscow Exchange.

Moscow Exchange looks forward to further developing the NTPro platform in close cooperation with the existing team.

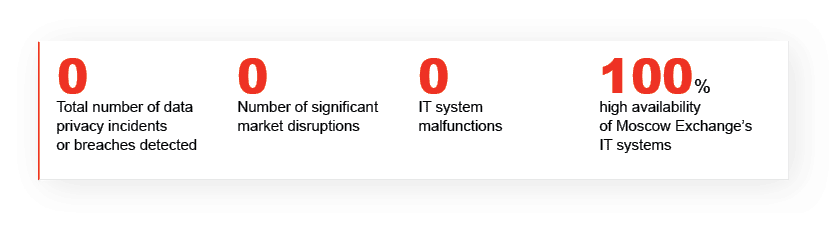

Availability of IT systems of Moscow Exchange

In 2021, the availability of the IT systems was a record-high 100%.

Extension of the trading time

In June 2020, in addition to the main trading session, Moscow Exchange launched an evening trading session that lasts from 7:00 p.m. to 11:50 p.m. for the MOEX Equity Market, increasing the total daily trading time on the Equity Market by almost five hours.

In March 2021, Moscow Exchange launched a morning trading session for the FX and Derivatives Markets which starts at 7:00 a.m. The total daily trading time increased by three hours: from 14 to 17 hours. The evening and morning sessions have improved the accessibility of the Russian financial market to all groups of investors and laid the groundwork for attracting new investors.

Extension of the trading period for the FX and Derivatives Markets makes exchange services more accessible to clients from Russia’s Far East and Asian countries.

Foreign shares

Moscow Exchange lists highly reliable issuers.

In 2020, Moscow Exchange Group successfully launched trading for 55 highly liquid stocks of leading international companies. In 2021, the list of available securities was expanded each month—a total of 466 stocks and depositary receipts of well-known major companies from various countries were admitted. As of the end of 2021, a total of 521 foreign stocks and depositary receipts were added. A total of 49 new corporate Eurobonds were added. The total number of listed Eurobonds reached 115 issues. The average daily trading volume with Eurobonds in 2021 exceeded RUB 1 billion, which is 24% more than in 2020.

In 2021, trading in foreign shares was up 744% compared to 2020, amounting to RUB 726 billion.

New IT services and upgrades to trading technologies

Rapid data access and trading technologies

Moscow Exchange Group provides a robust environment where equity market participants can analyze the market and make transactions.

Trading technology upgrades

SIMBA high-speed information distribution protocol

In October 2021, SIMBA, a new high-speed information distribution protocol for the Derivatives Market, was launched. The service allows clients to receive market signals faster. The service’s high speed is delivered by new software interaction between the SIMBA gateway and the central component of the trading system, along with the high-speed segment of the network infrastructure, which is designed specifically to transmit huge amounts of data to multiple recipients in real time.

TWAP

In keeping with global FX Market trends, Moscow Exchange Group launched the TWAP algorithm TWAP (Time-Weighted Average Price) is an algorithmic trading strategy aimed at keeping the average strike price close to the weighted average price of a security over a certain period of time specified by the user. , which enables market participants to assess the execution of their orders, comparing the price at which the order was executed at each time interval with the average price of transactions in the given period, and evenly convert a given volume over a predetermined period of time.

The TWAP algorithm helps traders avoid market impact, fight potential front-running Front-running is an unethical practice of making a profit by dealing in securities that will soon be bought or sold by an organization. , automate their work, and minimize operational risk. The service promotes compliance with ethical trading rules and mitigates the risk of fraud.

Spectra

The Spectra platform supports trading in futures within a negative price range and in options on such futures. A second-option pricing model and a model switch mechanism have also been introduced.

Trading access protocol for the Equity, Bond, and FX Markets

Banks, brokerages, algo-traders, and HFT-traders who place their hardware in MOEX’s data center can now use the FIFO MFIX Trade service to connect to the Equity, Bond, and FX Markets.

The interface operates a first in, first out (FIFO) algorithm that is strictly applied to process orders at the exchange gateway with more than 99% probability. This substantially improves the transparency and predictability of Moscow Exchange’s IT infrastructure operations.

The service aligns with global best practices and meets clients’ needs using high-frequency trading strategies that respond to market events within a fraction of a microsecond.

The FIFO MFIX Trade protocol is the fastest way to place orders on Moscow Exchange’s Equity, Bond, and FX Markets thanks to updated software and hardware. The dedicated network infrastructure within MOEX’s co-location space also facilitates this.

FIFO MFIX Trade network infrastructure upgrade

In June 2021, Moscow Exchange upgraded the network infrastructure of its FIFO MFIX Trade service—the fastest trading protocol for Equity, Bond, and FX Markets, launched in 2020. The solution’s capacity was upgraded for use by all interested market players. In response to client requests, the predictability of network infrastructure behavior and the accuracy of the TimeStamps service were upgraded as well.

Information security highlights

- no significant market disruptions that could cause a sharp drop in the market;

- no delays in the publication of market-relevant information;

- 0 cases of information system malfunction;

- 0 minutes of key information system downtime;

- RUB 0 in financial losses resulting from failures of the information security system and cybersecurity;

- no breaches involving personal data leakage or disclosure of confidential information.

Plans for 2022

In 2022, Moscow Exchange plans to:

- review and revise the current strategy;

- review the supply chain and import substitution;

- adapt the technological landscape and infrastructure to the revised strategy;

- introduce new risk management tools, including systems that incorporate machine learning and scenario analysis;

- train staff on anticipating probable events and threats;

- analyze financial and non-financial risks integrated in the risk map;

- arrange external quality assessment of the risk management system;

- audit information security in accordance with ISO 27001 and ISO 22301.