ADVANCED GOVERNANCE AND RESPONSIBLE BUSINESS PRACTICES

Figures for 2019, 2020, and 2021 are available in the subsection “Advanced governance and responsible business practices” of the section “Key Sustainability Data”. See the subsection “Advanced governance and responsible business practices” of the section “Sustainability Approaches and Procedures” for information on key policies, procedures, and responsible departments.

Moscow Exchange Group adheres to best practices and standards in corporate governance, ethics, and business conduct. The Group is also developing a system for internal control and risk management. Sustainability principles are reflected in the activities of the Group’s corporate governance bodies. The scope of issues considered at Supervisory Board meetings is expanding. Moscow Exchange continues to develop policies to regulate the management of sustainability-related issues, implementing best practices in business conduct among the Group’s companies, in the supply chain, and also among issuing companies and other financial market participants.

This subsection describes the current efforts of Moscow Exchange Group to develop a compliance system, as well as projects aimed at countering corruption and ensuring compliance with principles of ethical business conduct. It also covers measures aimed at further improving corporate governance at the Group’s companies.

- SDG 5.5 Ensure gender balance at the Company

- SDG 5.5 Promote gender balance in the business environment

- SDG 12.6, 13.3 Raise companies’ awareness of sustainability-related trends, standards, and practices

- SDG 4.7 Ensure the Group’s personnel have the competencies they need to manage sustainability issues effectively

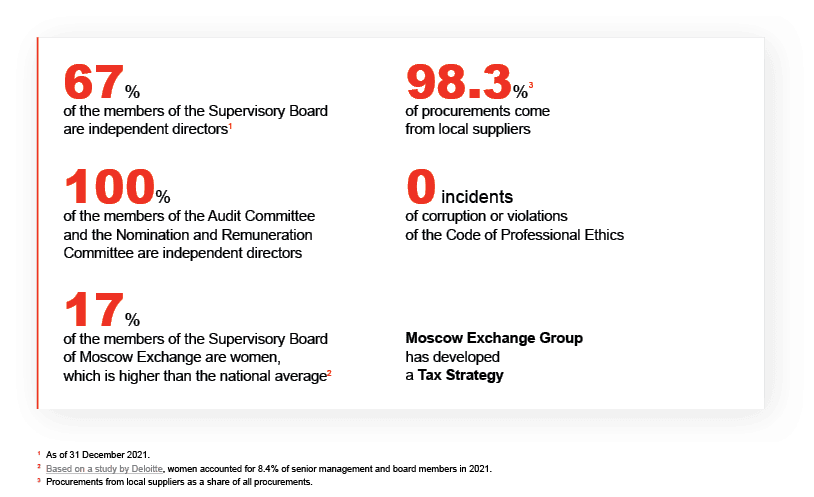

2021 highlights

Corporate governance

102-18

The corporate governance structure of Moscow Exchange consists of the General Shareholders Meeting, the Supervisory Board, the Executive Board, and Chairman of the Executive Board, who is the sole executive body.

General Shareholders Meeting

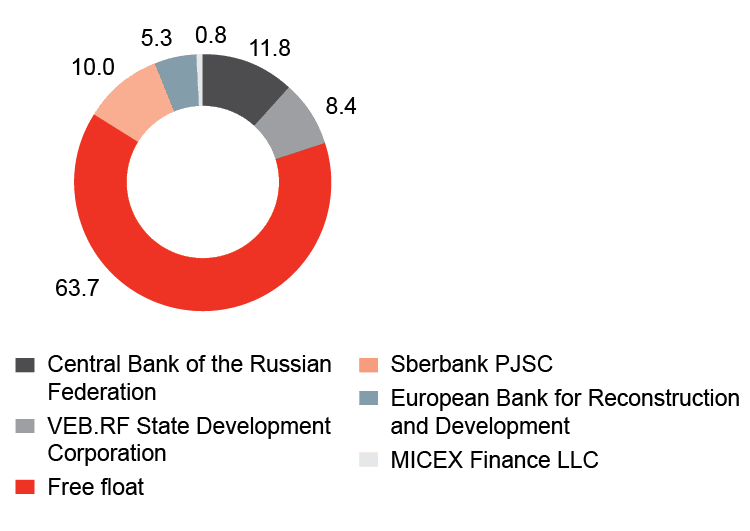

Moscow Exchange’s share capital structure is notable for:

- the absence of a controlling shareholder or shareholders with a stake exceeding 12%;

- high amount of shares in free circulation (over 60%).

Moscow Exchange strives to balance its shareholders’ interests; it performs its infrastructural function on the financial market effectively.

According to the Charter of Moscow Exchange, each share entitles the holder to one vote at the General Shareholders Meeting. See the 2021 Annual Report of Moscow Exchange and the official website for more details on the decisions made at general shareholders meetings.

Supervisory Board

In order to comply with the corporate governance requirements established by the Listing Rules, as well as to ensure the complete compliance with the Corporate Governance Code of the Central Bank of the Russian Federation, the following measures were taken in 2021 All data holds true as of 31 December 2021. :

102-22 102-23 102-24

- 8 independent directors were elected to the 12-person Supervisory Board;

- compliance with the independence criteria established by the Listing Rules was confirmed for all independent directors;

- an independent director was elected chairman of the Supervisory Board;

- the Audit Committee, as well as the Nomination and Remuneration Committee, included only independent members of the Supervisory Board.

See the 2021 Annual Report, pp. 65–73, for the composition of the Supervisory Board, as well as for the procedures for the appointment, induction, and training of Supervisory Board members.

102-29

In 2021, the Supervisory Board addressed the following issues:

- development of the carbon market and Moscow Exchange Group’s contribution to creating infrastructure for carbon accounting and trading;

- UN SDGs that are priorities for Moscow Exchange, as well as relevant tasks and performance indicators.

The companies of the Group plan to carry out further work on these issues.

102-33

The Supervisory Board keeps abreast of critical issues through a specialized system for supporting the governing bodies’ activities. Once information on critical issues is received, all Supervisory Board members are sent a special notification. In the reporting year there were no critical issues that would require the involvement of members of the Supervisory Board.

See the 2021 Annual Report, p. 73, for the issues considered by the Supervisory Board in 2021.

In 2021, the following committees operated under the Supervisory Board, carrying out preliminary consideration of issues and preparing decision-making recommendations:

- Strategic Planning Committee;

- Audit Committee;

- Nomination and Remuneration Committee;

- Risk Management Committee;

- Technical Policy Committee.

See the 2021 Annual Report, p. 65, for further information on the composition and functions of the Supervisory Board and its committees, as well as on the procedures for appointing their members.

Independent directors account for 100% of the Audit Committee. Independent directors account for 100% of the Nomination and Remuneration Committee.

102-18 102-22 102-25 102-29

Committee | Key tasks | Chairman | Members | Number of meetings |

|---|---|---|---|---|

Strategic Planning Committee | Improving the efficiency of Moscow Exchange and its subsidiaries through preliminary consideration and preparation of suggestions for the Supervisory Board on the drawing-up, development, and implementation of long- and medium-term strategic plans and objectives for Moscow Exchange | Ramón Adarraga | Paul Bodart Oleg Vyugin Dmitry Eremeev Maxim Krasnykh Oskar Hartmann | 10 |

Audit Committee | Ensuring the effective work of the Moscow Exchange Supervisory Board in resolving issues related to control over financial and economic activities (including audit independence), verifying the absence of conflicts of interest, and evaluating the findings of audits of Moscow Exchange’s financial statements | Paul Bodart | Ramón Adarraga Maria Gordon | 10 |

Nomination and Remuneration Committee | Ensuring the effective work of the Supervisory Board in resolving issues related to the activities of Moscow Exchange and of companies under the direct or indirect control of Moscow Exchange with regard to nomination and remuneration of the members of supervisory boards and governing bodies, as well as of other key executives and members of audit committees | Alexander Izosimov | Oleg Vyugin Maria Gordon Maxim Krasnykh | 13 |

Risk Management Committee | Participating in the improvement of the risk management system of Moscow Exchange and the Group in order to improve the reliability and efficiency of Moscow Exchange’s operations | Vadim Kulik | Valery Goreglyad Sergey Lykov | 12 |

Technical Policy Committee | Developing and improving the efficiency of Moscow Exchange and the Group by preparing recommendations and expert opinions covering technical policy and the development of IT and software for the Supervisory Board, the boards of directors (supervisory boards) of the Group’s companies and their committees, and for the governing bodies of Moscow Exchange and the Group’s companies | Vadim Kulik | Dmitry Eremeev Maxim Krasnykh | 6 |

102-30

The Supervisory Board approves risk appetite and risk management policies (including by topic), reviews reports on the risk management system, and decides on corrective measures based on those reports.

The Supervisory Board has a Risk Management Committee that also involves other companies of the Group in its activities.

Supervisory Board member | Travel expenses and other payments | Total remuneration for work on the Supervisory Board and committees, accounting for indexation | Remuneration for participation in governing bodies of subsidiaries | Total amount of all payments and compensation | ||

|---|---|---|---|---|---|---|

2019 | 2020 | 2021 | ||||

Ramón Morales Adarraga | 0 | 12,583 | 0 | 0 | 0 | 12,583 |

Paul Anne F. Bodart | 0 | 15,280 | 5,770 | 5,820 | 15,569 | 21,050 |

Oleg V. Vyugin | 1,850 | 20,510 | 0 | 17,800 | 24,627 | 22,360 |

Andrey F. Golikov (member of the Supervisory Board until 28 April 2021) | 0 | 14,843 | 3,822 | 20,029 | 26,108 | 18,665 |

Maria V. Gordon | 714 | 13,764 | 0 | 8,332 | 14,726 | 14,478 |

Valery P. Goreglyad | 0 | 0 | 0 | 0 | 0 | 0 |

Dmitry N. Eremeev | 0 | 10,930 | 0 | 0 | 10,433 | 10,930 |

Bella I. Zlatkis | 0 | 5,398 | 7,029 | 8,750 | 12,056 | 12,427 |

Alexander V. Izosimov | 0 | 13,764 | 0 | 9,321 | 15,379 | 13,764 |

Maxim P. Krasnykh | 0 | 12,954 | 0 | 0 | 0 | 12,954 |

Vadim V. Kulik | 0 | 11,065 | 0 | 3,250 | 4,000 | 11,065 |

Oskar Hartmann | 0 | 11,335 | 0 | 0 | 0 | 11,335 |

Evaluation of the effectiveness of the Supervisory Board and its committees

102-28 103-3

An internal evaluation of the Supervisory Board’s effectiveness took place in 2021, in the course of which its activities and those if its committees were analyzed. Priority areas for next year were identified, with a view to improving current corporate governance processes related to the performance of functions and separation of the governing bodies’ powers. The evaluation was carried out on an online platform, ensuring the anonymity of the participants and giving Supervisory Board members the freedom to express significant critical comments.

In order to ensure that the responses were representative, ten directors took part in the self-evaluation procedure. Most issues were commended by the members of the Supervisory Board.

- All participants in the evaluation indicated that Supervisory Board meetings are held in an appropriate place with a sufficient number of directors in attendance. The directors also noted the role of modern technologies in preparing materials.

- The Supervisory Board’s practices in monitoring the work of the chairman and members of the Executive Board and assessing their activities was universally recognized.

- The Supervisory Board’s practices in monitoring operational and financial results, approving crucial policies and procedures of the Group, and ensuring compliance with them were highly appreciated.

- The deep involvement and active participation of independent directors in meetings of the Supervisory Board, as well as their knowledge and preparedness, were confirmed.

- Regular meetings with the Group’s independent auditor were confirmed. Audit reports are duly reviewed to ensure the reliability of the Group’s financial statements and their timely submission to regulators.

- Compliance of the members of the Supervisory Board with the Privacy Policy was recognized unanimously.

- The work of the chairman of the Supervisory Board was commended.

The following tasks for improving the quality of corporate governance were identified during the self-evaluation:

- expand the consideration of issues related to fostering a corporate culture and ensuring compliance with the ethical principles of the Group;

- raise directors’ awareness of improvements in their colleagues’ skills, and improve directors’ knowledge and awareness of the Group’s activities;

- promote interaction between directors and mid-level executives;

- improve procedures for holding board and committee meetings.

Remuneration of executives at Moscow Exchange

The main elements of remuneration paid to the members of the Executive Board in 2021 are:

- a guaranteed component (salary);

- a variable component, including a short-term element (annual bonus) and a long-term element (remuneration under the Long-Term Incentive Program Based on Shares).

The short-term variable component depends on whether the approved KPIs have been met, including general corporate and individual indicators. In 2021, their ratio was 50/50; in 2022, in a bid to increase engagement in the Group’s results, it was made 70/30. Since 2020, the corporate KPIs have became individual KPIs for the chairman of the Executive Board of Moscow Exchange, i.e., they amount to 100%.

In order to increase the responsibility of executives, the Long-Term Incentive Program was launched, granting them the right to receive shares in stages.

No. | Full name | Position |

|---|---|---|

1 | Yury Denisov | Chairman of the Executive Board |

2 | Andrey Burilov | Executive Board |

3 | Maxim LapinLeft the post on 17 December 2021. | Executive Board |

4 | Igor Marich | Executive Board |

5 | Dmitry Shcheglov | Executive Board |

Type of payment | Amount of payment |

|---|---|

Remuneration payable separately for participation in the governing body’s activities | 0 |

Salary | 145,779 |

Bonuses | 148,672 |

Commission fees | 0 |

Remuneration for participation in the governing body of a subsidiaryMembers of the executive bodies of Moscow Exchange are not paid remuneration for their work on the governing bodies of other companies of the Group. | – |

Compensation of expenses | 0 |

Other types of remuneration | 7,457 |

Total | 301,908 |

In 2021, the Supervisory Board focused on implementing and updating the following documents and policies that had been approved in 2020:

- the risk appetite indicators and thresholds for 2021;

- the new edition of the Methods for Determining Risk Appetite Benchmarks;

- the Internal Audit Development Strategy;

- the Regulation on the Principles and Parameters of the Long-term Incentive Program Based on Shares;

- the new edition of the Information Policy.

Reliability of information on issuers

Moscow Exchange’s stance is consistent with international practice regarding the public disclosure of information by listed companies; financial, production, and ESG data; and changes that may affect share prices.

See the subsection “Responsible investing and sustainable growth” for details on requirements for issuers to disclose information that could affect the value of shares.

103-2

In 2021, Moscow Exchange updated its Listing Rules, which define the conditions and procedures for placement on the financial platform, the rules for delisting various types of securities, and other important details. According to this document, the inclusion of securities on the quotation list is subject to the following requirements:

- compliance of the securities with the current legislation of the Russian Federation, including regulatory acts of the Central Bank of Russia;

- assumption by the issuer of the obligation to disclose information in accordance with the requirements of the Law on the Securities Market and other legal acts of the Russian Federation, including regulations of the Central Bank of Russia.

Moscow Exchange conducts a review of securities for which applications have been submitted, checking issuers’ compliance against Moscow Exchange’s listing requirements. When preparing an expert opinion, the Listing Department considers official documents received by Moscow Exchange, information disclosed or submitted by the issuer, and messages posted on the websites of competent (regulatory) government authorities and organizations (self-regulated organizations, settlement depository, ratings agencies, organizations specializing in expert review of environmental and social projects, etc.). It may also consider information from the media and other sources.

Moscow Exchange monitors the compliance of market participants’ activities with the listing requirements. Should a violation of these requirements be detected, Moscow Exchange reserves the right to set a deadline to rectify it or to delist the securities.

NCC is guided by the Rules of Clearing on the stock market, the deposit market, and the loan market.

In 2021, the Central Bank of Russia published an information letter containing recommendations on disclosure by public joint-stock companies of non-financial information about their activities: companies are recommended to voluntarily disclose information on sustainability and ESG factors—including corporate governance — as well as environmental and social performance. Moscow Exchange supports the initiatives of the Central Bank of Russia.

Compliance system

Compliance The compliance system is designed for monitoring and managing risks of non-compliance with legislation, regulatory acts, principles of voluntary industry associations, and corporate policies and regulations. It also covers compliance with corporate ethics, anti-corruption measures, human rights, and other aspects of corporate conduct. is a crucial aspect of good corporate governance. The Group has built a compliance management system with developed business processes, procedures, corporate policies, and local regulations; risk assessments are carried out regularly (at least once a year) in all compliance areas.

The development of a corporate compliance culture and a unified approach to compliance risk management became an important area of corporate governance in 2021.

In 2021, Moscow Exchange was one of the first organizations in Russia to successfully pass an independent audit and receive a certificate confirming compliance of its corporate compliance system The certificate is valid until 2024. with ISO 37301:2021 Compliance Management System. The audit covered the following areas:

- anti-corruption;

- countering the legalization (laundering) of the proceeds of crime and the financing of terrorism;

- countering the misuse of inside information and market manipulation;

- settlement of conflicts of interest;

- exerting internal control over organized trading and activities as a financial platform operator;

- monitoring compliance with the tax legislation, including international legislation (CRS, FATCA CRS: Common Reporting Standard; FATCA: Foreign Account Tax Compliance Act. ), and with economic restrictions.

The compliance activities of Moscow Exchange Group are organized into two areas: internal and external:

- internal compliance involves ensuring that the activities of the Group’s companies comply with mandatory and voluntary requirements;

- external compliance consists of two aspects: 1) formalization of compliance requirements for issuers and bidders, and 2) informing market participants of best practices.

External compliance activities

In 2021, the Group implemented projects and held events for financial market participants in order to improve the quality of compliance with regulations and risk assessments.

- Under a joint initiative, the Central Bank of Russia, SRO, and Moscow Exchange Group developed a Code of Good Conduct for participants in trading and clearing by the Group. The draft document was discussed with traders. A mechanism for accepting the code and a communications channel for receiving and reviewing reports (the internal "SpeakUp!" intranet portal and compliance hotline) were created.

- The conference Compliance: Biggest Trends of 2021 was held for market participants. Trends and modern compliance techniques—designed to improve the quality of regulatory risk management—were reviewed at the event.

- Together with Deloitte, Moscow Exchange conducted and published the study AML/CFT. Survey of Market Participants. The aim of the project was to identify major problems in developing the AML/CFT AML/CFT: anti-money laundering and combating the financing of terrorism. function in financial institutions. Issues covered include the organization of the AML/CFT function, proper client verification, compliance with sanctions requirements, transaction monitoring, and more.

- A case study competition on business ethics, compliance, and sustainability was organized, with Moscow Exchange acting as sponsor. Participants were asked to describe a real-life situation involving decision-making amid an ethical and managerial dilemma. The winning cases may be used by universities in their management and economics programs, as well as by companies in training their staff.

- The compilation Typology of Unfair Practices in the Securities Market was prepared in conjunction with NAUFOR NAUFOR: National Association of Securities Market Participants. . The compilation contains descriptions of unfair and illegal actions when performing transactions involving financial instruments, and mechanisms designed to identify them.

The Group’s compliance practices

In accordance with the “Three Lines of Defense” model, the Supervisory Board of Moscow Exchange approves the Code of Professional Ethics, reviews reports, and assists in developing the ethics function. The managing director for compliance and business ethics is responsible for ethics and compliance-related issues; he/she is directly subordinate to the chairman of the Executive Board of Moscow Exchange.

The leader of the compliance function may take part in meetings of Moscow Exchange’s management bodies and committees, in risk assessments of new processes and products, and in procurement procedures.

A self-assessment of Moscow Exchange’s compliance system is carried out twice a year; external audits are carried out as part of the annual audit.

Failure by employees to comply with the Code of Professional Ethics and to complete mandatory compliance training affects the results of their annual evaluation.

The Group adheres to the open-door principle: employees are always welcome to ask for clarification, submit questions, or use the compliance portal. Moscow Exchange has developed an initiative to designate active employees who are interested in self-development and refinement of the Company’s compliance procedures ‘Compliance Ambassadors’. They attend training sessions on topics related to compliance culture, and their initiatives in the field of compliance and ethical behavior are reviewed and may be accepted.

The Group has designed technological solutions, including a communications channel (the anonymous SpeakUp! hotline—Moscow Exchange own creation) that can be used to report possible instances of corruption or violations of ethical business conduct and law. All employees are welcome to submit anonymous reports via the hotline and receive a response (applicants are sent a link to a web page where they can check the reaction of the Group’s companies). Moscow Exchange Group adheres to the principle of non-retaliation against employees who report problems.

In addition to the internal channel for employees, the Group has set up an external one for reports of corruption-related issues. Interested parties are welcome to use the hotline on the Moscow Exchange website. The number of reports received is reflected in the regular Sustainability Reports. NSD also runs a compliance hotline similar to SpeakUp! which complements the latter.

In 2021, 40 reports Data for Moscow Exchange and NCC. were received, including seven on possible professional ethics violations. There were no reports of corruption. All reports regarding potential compliance violations are investigated, and corrective action is taken whenever necessary.

The rest of the reports were general in nature and contained information about new and possibly unfair practices on financial markets, as well as suggestions for improving processes at companies of the Group. All appeals were processed by the Internal Control and Compliance Department; replies were sent within five business days.

206-1 205-3

In 2021, no lawsuits (pending or completed during the reporting period) regarding anti-competitive behavior or violation of antitrust legislation were filed against any companies of Moscow Exchange Group. There have been no confirmed cases of business ethics violations or corruption-related violations over the past three years.

Business ethics and anti-corruption

Corporate ethics and anti-corruption measures are important elements of the compliance system, and they are included in Moscow Exchange’s Compliance Program. These measures are constantly being improved in order to enhance the efficiency of operational processes, including by preparing reliable reporting, ensuring compliance with applicable laws, and developing a culture of trust in relations with employees and counterparties.

In 2021, a new Code of Professional Ethics The document was reviewed by the Executive Board and approved by the Supervisory Board in March 2021. based on an analysis of Russian and international best practices was approved. The document contains a number of new provisions and principles, some of which pertain to the sustainability agenda. All employees could take part in its preparation; 97% of Moscow Exchange’s employees voted in favor of the new version of the code. The code is published on the website of Moscow Exchange in Russian and English.

The Group’s companies have zero tolerance for corruption in any form. Approaches to anti-corruption management at the Group are set out in top-level documents and internal policies and regulations; they are also implemented in certain key regulations of the Group’s companies (such as the Regulation on Procurement). The main documents dealing with anti-corruption measures include the following:

- internal control rules to ensure AML/CFT compliance by the operator of the platform, as well as to prevent, detect, and suppress the misuse of inside information;

- the Anti-corruption Policy;

- the new edition of the rules for reporting violations and abuses.

The Group adheres to the principles of staff involvement in achieving zero tolerance of corruption, avoiding conflicts of interest, and ensuring that actions and procedures are proportional to the level of risks identified during periodic risk assessments.

The Anti-corruption Policy is publicly available; all partners and counterparties are informed of the Group’s stance and the availability of the corruption hotline. Counterparties undergo mandatory checks whenever procurement exceeds RUB 800,000. Compliance experts are involved in negotiating contracts that may entail corruption risks, including at the procurement stage, as well as in sponsorship and charitable activities.

In 2021, the Anti-corruption Policy of NCC was updated. The main changes included drafting more detailed anti-corruption principles, making the provisions on gifts and representation expenses more transparent, adding requirements applicable to charity and sponsorship, adding a new section on informing and training employees, creating a mechanism for reporting corruption-related violations via the SpeakUp! hotline, and accounting for organizational changes in NCC internal control system.

205-1 205-3

The companies of the Group monitor the effectiveness of and control over anti-corruption procedures. Self-assessments of the quality of corruption risk management are carried out regularly; reports are compiled for the Executive Board and the Audit Committee under the Supervisory Board of Moscow Exchange. Corruption risk assessments are conducted at all of the Group’s companies. In 2021, no incidents of corruption or violations of the Code of Professional Ethics were registered. No significant corruption risks were identified, either.

102-12

In 2021, Moscow Exchange signed the Anti-corruption Charter of Russian Business, thus indicating its willingness to follow the principles enshrined in it.

205-2

Moscow Exchange | NCC | NSD | |

|---|---|---|---|

Raising awareness of existing anti-corruption policies and methods, as well as the Code of Professional Ethics, % | |||

Members of the Executive Board and the Supervisory Board | 100 | 100 | 100 |

Employees | 100 | 100 | 100 |

Business partners | 100 (anti-corruption clauses are included in contracts with business partners) | ||

Training in anti-corruption policies and methods, including matters related to business gifts and conflicts of interest, number/% | |||

Employees | 1 188/92 | 263/91 | 640/103 |

Senior executives (members of the Executive Board) | 2/50 | 3/100 | 6/100 |

Leaders of functional departments | 156/60 | 70/117 | 92/86 |

Specialists | 1,030/101 | 190/85 | 520/104 |

All employees are required to read and accept the anti-corruption rules (through the electronic document management system, by affixing an electronic signature). Their awareness of the topic is then maintained through mandatory training sessions and briefings, as well as during events organized for the annual Compliance Day. Training is also provided on sanctions-related issues and compliance with tax legislation in regards to money laundering, countering terrorism, and other elements of compliance.

A range of training methods is used to keep personnel informed, including tests of varying complexity, depending on the employee’s position and level, newsletters reminding employees of corporate rules and tools (including the hotline), and relevant news. In 2021, a training course and an interactive film covering anti-corruption issues were created. The Group aims to raise awareness of the need for training in anti-corruption policies and methods by increasing the share of employees who have undergone training.

Approach to taxation

The Group’s tax strategy was developed in 2021 and approved in 2022. The strategy sets out the Group’s approach to taxation. Also in 2021, a number of data management measures were taken to automate inspections and tax payments.

See the section “Sustainability Approaches and Procedures” for detailed information on taxation issues.

Interaction with suppliers

102-9

The Group’s companies have transparent conditions for suppliers and contractors who wish to participate in the procurement process through bids and transactions. Guided by internal regulations such as the regulations on procurement, the Group’s companies guarantee the fulfilment of their contractual obligations.

102-10

The development of the Supplier/Counterparty Code of Business Conduct for the companies of Moscow Exchange Group began in 2021 in a bid to improve the business environment and reduce risks in the supply chain. It sets out principles of responsible business conduct which Moscow Exchange expects counterparties to comply with and which are to be taken into account when making procurements. The code is to be adopted in 2022.

Also in 2021, blocking criteria for evaluating counterparties in the main procurement areas were standardized in order to minimize the risk of conflicts of interest. In accordance with the updated Regulation on Procurement, Moscow Exchange tightened financial risk control over suppliers (in particular, subcontractor checks were introduced).

Area | Share |

|---|---|

Procurements, total | 100% |

IT | 85% |

Administrative | 8% |

Consulting and insurance services | 4% |

Marketing and PR, including: | 2% |

Security | 1% |

HR | 0.12% |

204-1

In 2021, contracts worth RUB 6.9 billion were concluded for the supply of products and services, RUB 3.3 billion of which was for goods and RUB 3.6 billion of which was for services. The total number of suppliers exceeded 240 organizations (up from 220 in 2020); 98.3% of all procurements were from Russian suppliers Russian suppliers are considered local suppliers for the Group. .

Plans for 2022

The following corporate governance tasks have been set for 2022:

- conduct an independent assessment of the Supervisory Board’s effectiveness;

- determine a pool of successors for the members of the Supervisory Board;

- formalize the Group’s management system.

To expand the scope of work and assist employees in the area of compliance, the Group’s companies have set the following objectives:

- implement initiatives in accordance with the Compliance Roadmap;

- take measures to develop risk and compliance culture.

To implement ESG principles throughout the supply chain, Moscow Exchange Group is planning to take the following actions:

- approve the Supplier Code of Business Conduct and introduce a procedure for signing a document (or a form) confirming that counterparties are familiar with Moscow Exchange’s requirements;

- continue improving the planning, consolidation, and automation of procurement procedures for Moscow Exchange Group.

The Group’s plans for 2021 and the coming years in the areas of internal audit, business ethics, and anti-corruption include continuous work on the Compliance Roadmap, which envisages improving procedures and automating compliance-related risk management processes.