RESPONSIBLE INVESTING AND SUSTAINABLE GROWTH

For comprehensive performance metrics for 2019, 2020 and 2021, see the subsection “Responsible investing and sustainable growth” of the section “Sustainability Data” For the key policies, procedures, and responsible departments, see the subsection “Responsible investing and sustainable growth” of the section “Sustainability Approaches and Procedures”.

Exchanges contribute significantly to raising capital for improving sustainability. They also play an important role in in creating financing facilities to help modernize the economy in line with climate goals.

As a member of the Sustainable Stock Exchanges (SSE) initiative, Moscow Exchange works hard to develop sought-after financial ESG instruments and promote them among Russian companies, investors, and financial institutions. Moscow Exchange is striving to create a new market segment for environmentally and socially significant projects that are appealing for issuers and investors.

Moscow Exchange promotes responsible investment both as a company and as a provider of financial infrastructure, recognizing that the generation of long-term sustainable returns is dependent on well-governed social, environmental, and economic systems.

Moscow Exchange Group also promotes modern corporate reporting requirements, thereby contributing significantly to more transparent markets. The Exchange has developed infrastructure to foster a local investor base, and it provides access to funding for innovative companies, as well as small and medium-sized enterprises.

FN-EX-410a.3 103-2

Moscow Exchange requires issuers to disclose the following information that may affect stock prices:

- changes related to the company’s financial health;

- major corporate transactions, including restructurings, mergers, and acquisitions;

- changes to the management team;

- positive or negative material information on issuers’ products and services;

- legal or regulatory changes affecting the company’s ability to conduct business.

The grounds for suspending trading in securities are set out in the Listing Rules of Moscow Exchange, pp. 76–77. The decision to suspend trading in securities is made by Moscow Exchange on the basis of an expert opinion issued by the Listing Department. Moscow Exchange contributes significantly to increased transparency of disclosures through its requirements for issuers.

103-3

As part of the work of the Bond Issuers Committee and user committees, Moscow Exchange performs regular analyses of feedback from customers and market participants about new ESG products; it also works to increase their awareness on such topics.

This subsection covers the key responsible investment instruments of Moscow Exchange and its educational programs for market participants.

- SDG 8.3, 9.3 Increase growth opportunities and access to financial markets for small and medium-sized enterprises

- SDG 8.10 Develop financial infrastructure for better access to capital markets, promote the development of a local investor base

- SDG 9.1 Increase access to financial services for retail investors

- SDG 9.b Increase growth opportunities and access to financial markets for companies that develop innovative products

- SDG 12.6, 12.8 Improve the quality and quantity of ESG information disclosed by issuers

- SDG 12.6, 13.3 Develop instruments to promote responsible investment

Major highlights in 2021

Sustainability sector

103-1

In 2019, Moscow Exchange Group established the Sustainability sector to help issuers raise funds for projects that comply with the UN SDGs and national projects of the Russian Federation. The Sustainability sector consists of four segments: green bonds, social bonds, sustainability bonds (as of 2021), and a segment for national and adaptation projects. For more details on the Sustainability sector and its core listing rules, see the section “Sustainability Approaches and Procedures”.

In 2021, the Group expanded its offerings of sustainability-related products and services for issuers and investors committed to sustainable development strategies.

FN-EX-410a.4

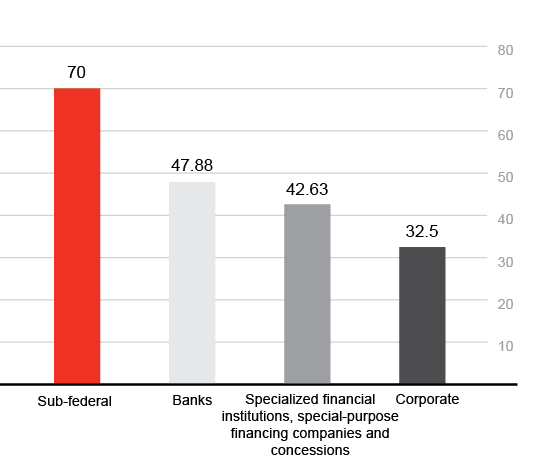

A new edition of the Listing Rules of Moscow Exchange came into force on 21 May 2021. According to the rules, the Sustainability sector can include sub-federal and municipal bonds issued to raise funds for environmental projects and socially significant initiatives.

On 28 December 2021, the Listing Rulesof Moscow Exchange were once again revised in line with regulatory changes of the Central Bank of Russia. The Listing Rules have been brought into conformity with new provisions of the Securities Issuance Standards.

103-2

The following changes have been made in the Sustainability sector.

- a new segment, Sustainability Bonds, has been added to help raise funds for both environmental and social projects;

- the National Projects segment has been renamed the National and Adaptation Projects segment. It will include bonds to raise funds for projects compliant with the VEB.RF Taxonomy goals.

FN-EX-410a.4

- provisions have been made for an independent external compliance audits of issuers’ projects and policies’ with the Russian Green Finance Guidelines and the VEB.RF Taxonomy;

- Moscow Exchange is exploring the possibility making ESG disclosures mandatory for issuers.

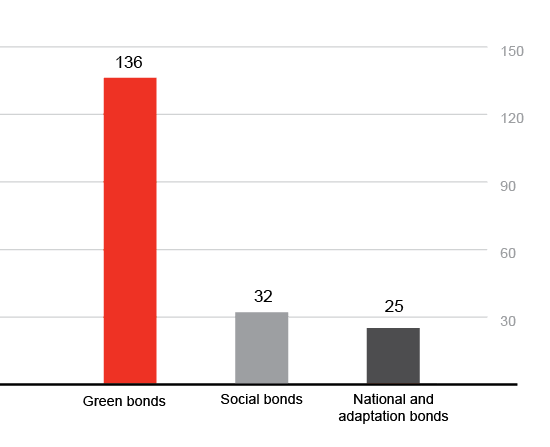

As of 31 December 2021, there were 22 issues of ESG bonds by 13 issuers in the Sustainability sector, 10 of which were issued in 2021 (five issues of green bonds, two issues of social bonds, and three issues in the national and adaptation projects segment, including the first-ever issue of adaptation bonds in Russia). In total, compared to 2020, the value of bonds traded was up by a factor of 14.7, amounting to RUB 169.4 billion, with green bonds accounting for the largest share.

According to NSD, financial market participants invested RUB 152 billion in ESG bonds in 2021, and, as of the end of the year, held securities worth RUB 175.4 billion on their accounts.

Building a market for trading in carbon units

In 2021, Moscow Exchange and a major Russian bank agreed to implement a joint project to build the Russian carbon trading market. The Supervisory Board of Moscow Exchange approved it.

103-1

The project is vital for fulfilling Russia’s obligations under the Paris Agreement and keeping exporters competitive. The transition to a lower-carbon economy requires an intermediate adaptation stage, with climate-related projects as an instrument for regulating emissions. These projects aim to establish trading in carbon units to help harmonize economic relations between commodity market participants, subject to agreements being reached at international level to set out the rules for the new market mechanisms.

103-2

Federal Law No. 296-FZ dated 2 July 2021 “On Limiting Greenhouse Gas Emissions”calls for the creation of a carbon unit registry whose operator is authorized by the Russian Government.

After studying the issue, the Ministry of Economic Development proposed the creation of an operator for the carbon unit registry with the participation of Moscow Exchange. The corresponding infrastructure is being developed based on an existing legal entity, Kontur JSC.

As a partial operator of the carbon unit registry, Moscow Exchange’s tasks will include:

- supporting processes on the operator’s platform;

- participating in the development of methodological and regulatory documents governing the relevant processes, and interacting with customers of the registry, public authorities, and international organizations;

- drafting proposals for participation in the organization of carbon unit trading and implementing such proposals together with other parties.

In cooperation with other interested parties, Moscow Exchange plans to build a regulatory framework and a system of requirements for the sale of GHG emission permits and green certificates.

This system is expected to reduce negative anthropogenic impacts on the climate to mitigate certain acute and chronic climate-related risks. The centralized emissions trading system may be based on limited emission allowances (cap-and-trade system) or on their specific levels (baseline-and-credit). Companies that pollute will acquire permits for emissions while also implementing initiatives for the reduction of GHG emissions. NSD may become an operator of the carbon unit registry.

ESG guidelines

103-2

To better integrate ESG principles into companies’ operations, it is vital for exchanges the world over to educate and inform participants on financial and commodity markets. Moscow Exchange holds conferences and webinars, and also supports thematic partner events.

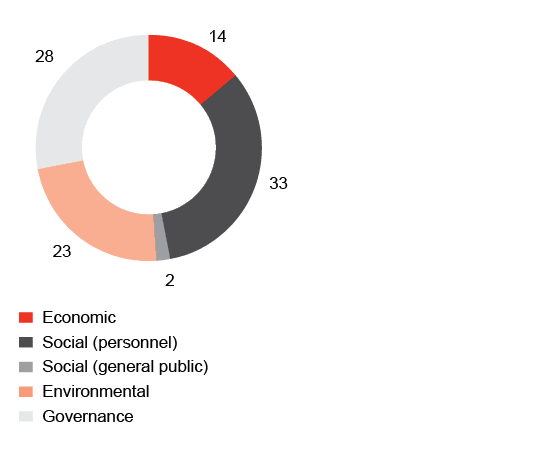

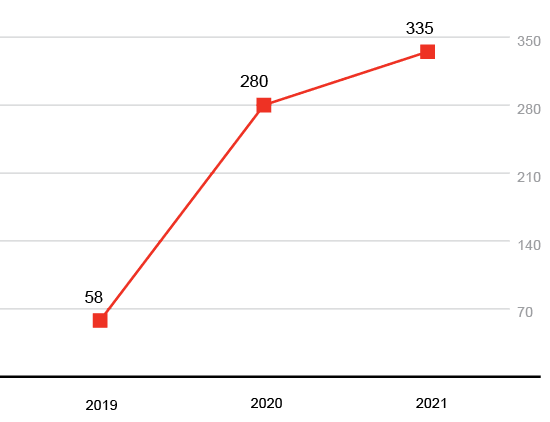

In the summer of 2021, Moscow Exchange developed and published the ESG Disclosure Guidelines for companies seeking to establish sustainable business models. These guidelines include recommendations on developing ESG strategies and improving corporate governance. They also cover practical aspects of the financial market, with a focus on responsible investment principles and ESG best practices. The Guidelines can be used to develop or improve corporate ESG strategies and promote higher-quality corporate governance and a better understanding of ESG-oriented sustainable business models. The presentation unveiling the Guidelines was attended by 361 participants.

ESG indices

103-1 FN-EX-410a.4

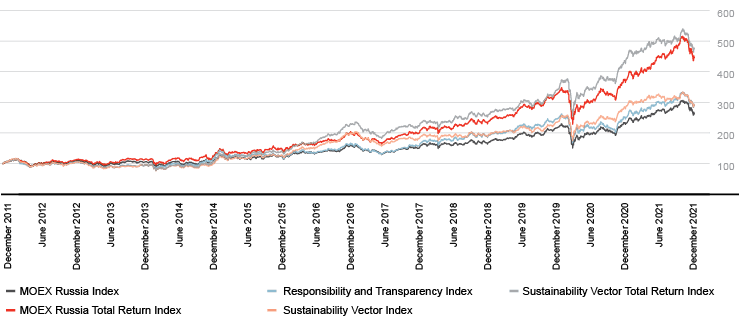

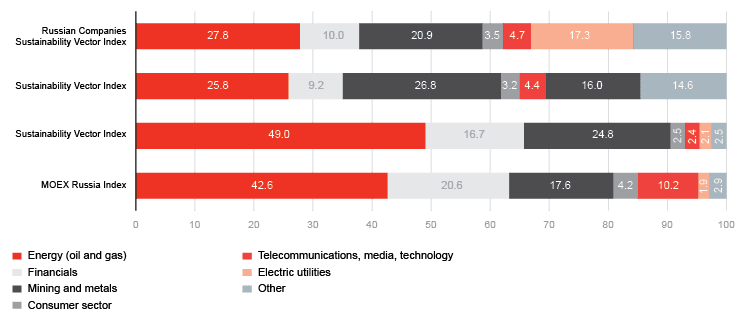

Moscow Exchange Group calculates and tracks Russia’s first sustainability indices. This is a joint project with the Russian Union of Industrialists and Entrepreneurs (RSPP). The MOEX-RSPP ESG indices help reveal a correlation between the quality of disclosures on responsible business practices and the yield dynamics of issuers’ stocks.

103-2

Each year, RSPP evaluates reports and ESG indicators of companies with considerable market capitalization operating in Russia. Moscow Exchange stock indices are based on this evaluation, as well as their derivatives, which create the basis for ESG ETFs “ETF” means Exchange-Traded Fund. . Since January 2021 Moscow Exchange has been listed on the RSPP Responsibility and Transparency Index and the Sustainability Vector Index.

- MOEX-RSPP Responsibility and Transparency Index, MRRT (calculation is based on the stock prices of 29 issuers Data is provided as of 31 December 2021. );

- MOEX-RSPP Sustainability Vector Index, MRSV (calculation is based on the stock prices of 26 issuers Data is provided as of 31 December 2021. );

- MOEX-RSPP Sustainability Vector Total Return Index (calculation base includes companies with the best sustainability indicator dynamics, taking into account reinvestment of dividends);

- MOEX-RSPP Russian Companies Sustainability Vector Index (launched in 2021);

- MOEX RSPP — RSHB Russian Corporate Eurobonds ESG Index (launched in 2021; based on the Eurobond loans of Russian corporate issuers listed on the MOEX-RSPP Sustainability Vector Index).

MOEX-RSPP Responsibility and Transparency Index | 29 |

MOEX-RSPP Sustainability Vector Index | 26 |

MOEX-RSPP Russian Companies Sustainability Vector Index | 24 |

MOEX RSPP — RSHB Russian Corporate Eurobonds ESG Index | 17 |

A new version of the Sustainability Vector Index, the MOEX-RSPP Russian Companies Sustainability Vector Index, was launched in 2021. The methodology factors in regulatory requirements for non-state pension funds, making it possible to invest pension savings in a basket of index-linked securities or a financial product whose underlying asset is the new indicator.

Moscow Exchange has also started calculating the RSPP-RSHB Russian Corporate Eurobonds ESG Index. This derivative index has become the basis for a new ETF managed by RSHB Asset Management.

The year 2021 saw the introduction of tighter requirements on the liquidity of securities included in sustainability stock indices: a liquidity ratio was introduced, and free float requirements were put in place (regulating the share of stocks that are publicly traded, including those available to retail investors).

FN-EX-410a.4

A total of 43 indicators were used to calculate the RSPP Responsibility and Transparency Index in 2021.

ESG ETFs

The establishment of derivative indices based on the ESG indices of Moscow Exchange in 2021 led to the launch of four new ESG ETFs: ESGR ETF RSHB-MOEX-RSPP VecTR (ESGR, the second ETF managed by RSHB Asset Management LLC), SBRI ETF Responsible Invest (SBRI), WIMF ETF Russian Equity ESG (VTBF ETF) and TSST ETF TINKOFF ESG LEADERS (TSST).

The new ETF of RSHB was awarded “First Exchange-Traded Fund in the ESG Segment” at the Investfunds Awards. The award is given to companies that show outstanding results in the collective investment market.

Growth sector

103-2

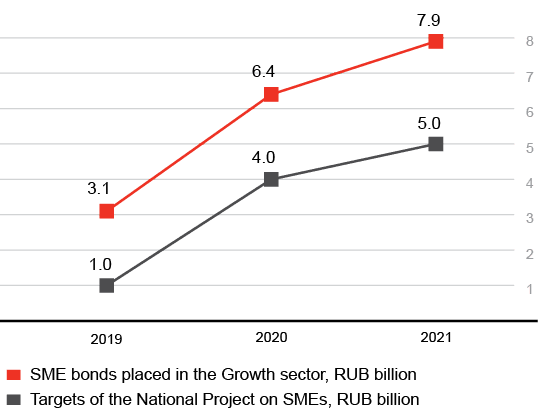

In 2021, MOEX Group extended access to funds for small and medium-sized enterprises (SMEs) in the Growth sector, thereby facilitating their growth. The number of SMEs included in the Growth sector and the volume of offerings grew, reaching the targets of the national project “Small and Medium-Sized Enterprises and Support of Individual Entrepreneurship Initiatives”.

The Growth sector of Moscow Exchange In cooperation with the Central Bank of Russia, the Ministry of Economic Development of the Russian Federation, SME Corporation, and SME Bank JSC. was created for public offerings and for circulating the securities of promising small and medium-sized enterprises (for a detailed description of the sector and its listing rules, see the section “Sustainability Approaches and Procedures”).

To be included in the Growth sector, bonds need a credit rating of at least BB- on the Russian scale. In view of the current situation, until 1 October 2022 Moscow Exchange has decided to use the credit ratings of the issuer, bond issue, or guarantor (endorser), assigned as of 1 February 2022.

As of 31 December 2021, 47 bond issues of 28 SMEs were traded in the sector. The total volume of SME bond placements amounted to RUB 7.9 billion, which RUB 2.9 billion above the target under the national project.

To subsidize listing preparations, 16 issuers received RUB 24.65 million in pre-listing subsidies, and 20 transactions received coupon-interest income subsidies totaling RUB 128.3 million.

103-2

As a COVID-19-related support measure, Moscow Exchange Group has improved accessibility to the bond market for SMEs by waiving charges for listing bonds for flotations of up to RUB 400 million. In 2021, the grace period was extended up to 31 December 2022.

Innovation and Investment Market

Moscow Exchange contributes to the development of the innovation market by easing access to the financial market for high-tech companies. Moscow Exchange’s goal is to attract investment to innovative companies using its exchange mechanisms and through cooperation with development institutions.

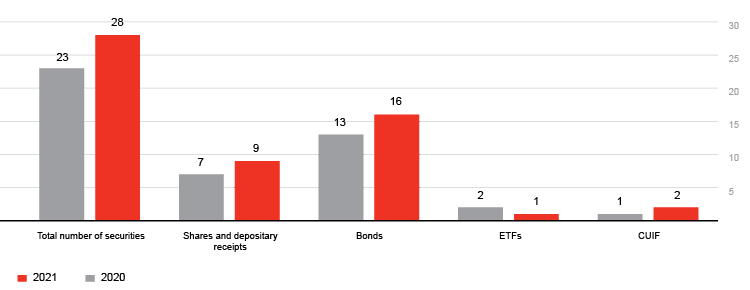

By the end of 2021, 28 securities were being traded on the Innovation and Investment Market (IIM) sector, including seven shares, two global depositary receipts (GDRs), 16 bonds, one exchange-traded fund (ETF), and two closed-end unit investment funds (CUIF). The total capitalization of the sector amounted to about RUB 460 billion. The trading volume exceeded RUB 300 billion (+20% YoY). IIM issuers include companies from the following industries: biotech and medical technologies, internet and media, IT and telecommunications, and innovative technologies. In 2021, nine new securities were offered on the IIM.

To encourage high-tech companies to list on the stock exchange, the following types of government support are available:

- tax relief on income from the sale or other disposal of shares and bonds of Russian entities, and of investment units that are securities from the high-tech (innovative) sector of the economy, provided that they have been continuously owned by the taxpayer for at least one year prior to the date of their sale (effective until 31 December 2022);

- as part of the initiative "Takeoff – From Startup to IPO", approved by the Russian Government in 2022, small innovative enterprises will be eligible for grant support to co-finance innovative projects, with the grants to be provided by Federal State Institution Foundation for Assistance to Small Innovative Enterprises in Science and Technology. Each grant is capped at RUB 25 million; part of that amount may be spent on listing (legal support fees, investment banking services, marketing, and other services).

Outlook for 2022

In 2022, the Group plans to keep improving its responsible financing practices:

- continue to develop the Sustainability sector by issuing new types of bonds; create platforms for ESG market data; extend the ESG index family; improve the non-financial reporting practices of issuers;

- launch a carbon trading system;

- host more educational events for issuers and market participants to share knowledge and experience in ESG management and responsible investment;

- improve the Group’s own ESG practices and sustainability reporting system;

- meet KPIs under the national SME projects in terms of the size of securities offerings;

- boost the IIM Sector through the “Takeoff — From Startup to IPO” government initiative.